Pre-Purchase Due Diligence: Five Technical Risks That Turn Viable Sites Into Money Pits

The telephone call came three weeks after exchange of contracts. The developer had purchased a two-acre site for £850,000, assuming straightforward development of twelve houses. Post-acquisition ground investigation revealed contamination requiring £180,000 remediation. Utility searches showed the electricity substation was at capacity, with a £95,000 contribution needed for reinforcement. A topographical survey identified drainage falls that required a pumping station at £120,000. The site economics had collapsed.

"We assumed our solicitor's searches would catch any problems," the developer explained. They hadn't. Standard conveyancing searches identify legal restrictions, planning history, and coal mining risks—valuable information, but insufficient for assessing development viability. The technical abnormals that killed this project's profitability were invisible until specialist surveys were commissioned post-purchase, when the developer was already contractually committed.

This pattern repeats constantly in the development sector. Competitive land markets create pressure to exchange quickly. Vendors discourage extensive pre-purchase investigations. Developers rely on visual site inspection and conveyancing searches, then discover costly surprises after acquisition. By then, the only options are absorbing unexpected costs or walking away and losing deposits.

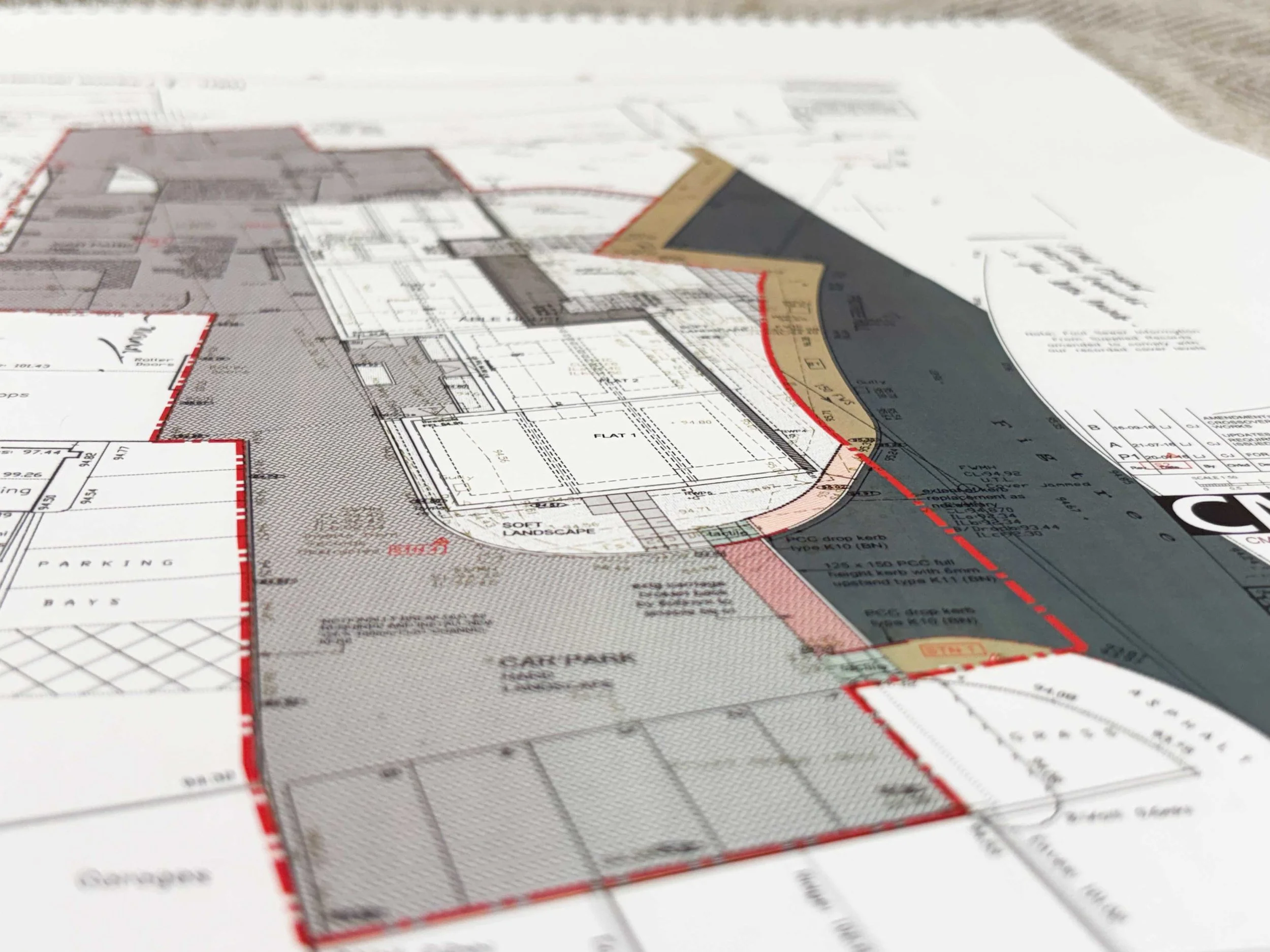

The solution is comprehensive technical due diligence before exchange—systematic assessment of the physical, technical, and regulatory factors that affect development cost and viability. According to the RICS Professional Standard on Technical Due Diligence of Commercial Property (RICS), this structured approach identifies risks that conventional property searches miss. It's not about finding reasons to reject sites—it's about understanding what you're buying and pricing risk appropriately.

Let's examine five technical risks that routinely turn apparently viable sites into money pits, and the due diligence process that identifies them before you're committed.

Risk 1: Boundary & Title Complications

The site looked perfect: 1.5 acres on the edge of a market town, outline planning permission for eight dwellings, asking price £650,000. The developer's calculation assumed £195,000 per plot, construction at £150,000 per unit, and sale values around £425,000. The numbers worked comfortably.

Due diligence revealed a problem. The red line on the planning permission included a narrow access strip—just 3.5 metres wide—that crossed land in third-party ownership. The developer owned the development area but not the access to it. The third party, spotting leverage, wanted £180,000 for a right of way. The site economics evaporated.

The Red Line vs Blue Line Problem

Planning applications distinguish between the red line (the application site—the land where development is proposed) and the blue line (other land in the applicant's ownership). Crucially, the red line can include land you don't own, provided you notify the owners. This allows applications for development that requires off-site access or services across neighbouring land.

The problem emerges post-planning when you attempt to implement the permission. If you don't own or control the access, you cannot legally build. The third-party landowner has you in a ransom position—they can demand almost any price because you cannot develop without their cooperation.

According to Property Week's case studies on development constraints, ransom strips are remarkably common, particularly on former agricultural land where historic field access tracks cross multiple ownerships, or on backland sites where access runs through residential garden land. Many sites appear to have straightforward access until title plans are examined in detail.

What to Check

Pre-purchase due diligence must include comprehensive Land Registry title examination, not just for the development site but for all surrounding parcels that might affect access. Order official copies of the register and title plan for the site and any land the red line crosses.

Scrutinise the property register for rights of way, easements, and restrictive covenants. Check the charges register for mortgages or legal restrictions. Examine the title plan to verify boundaries and identify whose land the access crosses.

If access depends on a right of way, verify it actually exists in the legal title—not just on an outdated plan or in someone's memory. Check whether the right of way permits residential development traffic (many agricultural or domestic rights of way don't extend to construction or residential use). Verify the width is adequate for highways authority requirements (typically minimum 4.8 metres for adoptable estate roads, though non-adoptable private drives can be narrower).

Historical ownership research can reveal boundary disputes, adverse possession claims, or competing interpretations of where boundaries run. Local authorities sometimes maintain records of historical planning applications showing different boundary alignments—inconsistencies that suggest uncertainty about legal ownership.

The Cost of Getting It Wrong

Sites requiring additional land purchases or ransom strip negotiations rarely proceed on the original economic model. The third party knows you're committed and has little incentive to be reasonable. Even if agreement is reached, legal costs and delays compound the damage.

Some developers attempt to challenge boundaries through adverse possession claims, but this requires 10 years for registered land (under the Land Registration Act 2002, subject to objection procedures) or 12 years for unregistered land (Limitation Act 1980)—impossible for recently acquired land. Others explore alternative access routes, but these usually require planning permission amendments, additional land acquisitions, and highways authority approvals—expensive and uncertain.

The £10,000-15,000 cost of comprehensive pre-purchase legal and technical due diligence is modest insurance against discovering, post-purchase, that your site has boundary problems that undermine viability. Land Registry title plans and precise boundary surveys identify these issues before you're contractually committed.

Risk 2: Ground Conditions & Contamination

Visual site inspection suggested a straightforward greenfield development. The site had been agricultural pasture for decades, with no obvious signs of previous industrial use. Ground investigation post-purchase revealed otherwise.

Historical mapping showed the site had been a brickworks until the 1950s, closed and backfilled with demolition rubble and industrial ash. The made ground extended three metres deep across 40% of the site. Contamination testing identified elevated levels of heavy metals and polyaromatic hydrocarbons. The Phase 2 consultant concluded that remediation would be required to satisfy planning and environmental regulatory requirements.

The Hidden Beneath

Ground conditions directly affect foundation design and cost. Sites with poor bearing capacity require piled foundations or ground improvement—potentially doubling foundation costs compared to simple strip footings. Made ground (artificial fill material) is unpredictable in depth and composition, creating differential settlement risks that require expensive foundation solutions.

Contamination is remarkably common on brownfield sites, but also appears on apparently clean land. Former orchards may contain arsenic and lead from historic pesticides. Former rail land often harbours hydrocarbon contamination from coal and oil. Any site near historical industrial use—even if not itself industrial—may have received contaminated fill.

The Designing Buildings Wiki's technical due diligence overview (Designing Buildings) emphasises that contamination remediation can cost £50-£200 per square metre depending on contaminant type and concentration. For a one-acre site (approximately 4,000 square metres), that's potentially £200,000-£800,000 of unexpected cost. Even worse, remediation delays programme—typically adding 8-16 weeks whilst materials are excavated, validated, and disposed of at licensed facilities.

Japanese knotweed and other invasive species create additional headaches. Treatment requires specialist contractors, takes multiple growing seasons, and creates liability if the plant spreads to neighbouring land. Mortgage lenders increasingly refuse to lend on properties affected by knotweed, making completed units unsaleable until the issue is resolved.

What to Check

Phase 1 desk studies examine historical mapping, industrial use records, and environmental data to assess contamination risk. These cost £1,500-£3,000 and should be commissioned before exchange. If the Phase 1 identifies potential risks, a Phase 2 intrusive investigation—involving trial pits and laboratory analysis—quantifies the problem. This costs £5,000-£15,000 depending on site size but provides the definitive answer about whether remediation is needed.

Review Environment Agency databases for historical industrial sites, pollution incidents, and landfill locations. The Coal Authority provides mining reports for areas with historical coal extraction—essential in former mining regions where ground instability and mine gas create foundation challenges.

Harrison Clarke's technical due diligence guidance (Harrison Clarke) recommends Japanese knotweed surveys before purchase—visual inspection by a specialist who knows what to look for. Knotweed dies back in winter, so timing matters. The plant is notoriously difficult to eradicate once established, and treatment costs can exceed £20,000 for modest infestations.

When to Walk Away

Some contamination is commercially manageable—the cost is quantified, factored into the purchase price, and absorbed within project economics. But certain scenarios justify walking away entirely.

If remediation costs exceed 10-15% of total development value, site viability is threatened. If contamination is so severe that it requires off-site disposal at hazardous waste facilities, costs escalate dramatically—potentially £150-300 per tonne for treatment and disposal. A site requiring removal of 2,000 tonnes of contaminated soil could incur £300,000-600,000 in disposal costs alone.

Contaminated water tables create ongoing liability. If groundwater pollution requires monitoring and treatment in perpetuity, the developer may face environmental liabilities extending decades beyond completion. Most developers reasonably avoid this level of long-term risk.

The key is identifying ground conditions before purchase, when you can negotiate the price to reflect remediation costs or walk away if the numbers don't work. Post-purchase, you have neither option.

Risk 3: Infrastructure & Utilities Abnormals

The development appeared straightforward: an edge-of-village site with road frontage and existing utility connections serving adjacent properties. Surely infrastructure connections would be simple?

Utility searches revealed otherwise. The electricity distribution network was at 95% capacity. The local substation couldn't accommodate additional load without reinforcement—a £110,000 contribution with an 18-month lead time. Water mains were adequate, but foul sewerage required a new pumping station and rising main to the treatment works 800 metres away—estimated at £145,000 plus ongoing maintenance liability.

Highways pre-application advice identified visibility splay requirements that necessitated third-party land acquisition and a Section 278 agreement for off-site junction improvements—£85,000 of works that hadn't been budgeted.

The Connection Challenge

Infrastructure capacity is often the hidden constraint on development. Utility companies assess each connection request individually, and just because adjacent properties are connected doesn't guarantee your development can be accommodated. Network capacity depends on overall demand, not individual connections.

Electricity networks in rural and semi-rural locations frequently operate near capacity. Housing developments create substantial additional load—electric heating, vehicle charging points, modern appliances—that can overwhelm ageing infrastructure. Distribution network operators (DNOs) may require substation upgrades, transformer installations, or new high-voltage cables as a condition of connection. These costs typically fall to the developer through "connection charges" that can reach six figures.

Water supply infrastructure similarly has finite capacity. Developments in water-stressed regions may face restrictions or requirements for water efficiency measures beyond Building Regulations minimums. Water neutrality requirements—now applicable across large parts of England—demand that developments demonstrate no net increase in water consumption, often requiring offset measures costing £3,000-5,000 per dwelling.

The S278 & S104 Reality

Section 278 of the Highways Act 1980 governs works within the public highway. If your development requires a new junction, visibility improvements, traffic signals, or pedestrian facilities, you'll need a S278 agreement with the highway authority. These agreements require technical approval, financial bonds, and supervision fees—but more significantly, they require the actual highway works, which can be extraordinarily expensive.

A simple junction improvement—widening bell-mouths, improving visibility, upgrading drainage—can cost £50,000-150,000. Traffic signal installations exceed £200,000. If your site requires off-site highway improvements extending hundreds of metres—perhaps footway construction or road widening—costs escalate into £300,000-500,000 territory.

Section 104 of the Water Industry Act 1991 covers sewer adoption. If the existing sewer network cannot accommodate your development's foul flows, you may need to upsize sewers, install pumping stations, or provide off-site improvements. Water companies assess hydraulic capacity through sewer modelling—if the model shows flooding risk, reinforcement works are required before your development can connect.

Homes England's Development & Regeneration Technical Services Framework (GOV.UK) emphasises that infrastructure abnormals are a primary cause of development unviability. The difference between a straightforward connection and one requiring substantial off-site works can be £200,000-400,000—enough to render a site uneconomic.

What to Check

Commission comprehensive utility searches (C3 and C4 reports) that show existing infrastructure locations and provide contact details for capacity assessments. Then—and this is the crucial step—actually contact the utility companies and request formal capacity assessments. Don't rely on proximity to existing infrastructure as evidence of available capacity.

For highways, the single most valuable due diligence step is pre-application advice from the local highway authority. Submit a simple plan showing proposed access location and request written confirmation of acceptability. Highways officers will identify visibility splay requirements, junction design standards, and any off-site works required. This written advice—typically costing £500-2,000—can save discovering £150,000 of unexpected S278 costs post-purchase.

Budget Impact

Infrastructure abnormals must be factored into the land purchase price. If you're bidding £800,000 for a site assuming £50,000 of normal connection costs, but due diligence reveals £250,000 of abnormals, the land value falls to £600,000 (assuming everything else remains equal). If the vendor won't reduce the price accordingly, the site isn't viable at the asking price—walk away.

Developers who skip infrastructure due diligence essentially gamble that abnormals won't arise. Sometimes they win that gamble. Often they don't, and by then they're committed to a site with uneconomic infrastructure requirements. That's not a commercial risk—it's an avoidable error.

Risk 4: Drainage & Flood Risk

Flood zones are clearly marked on Environment Agency maps, so surely flood risk is easy to assess? Unfortunately, the reality is more complex. Flood Zone 1 indicates low probability of river or sea flooding, but it says nothing about surface water flooding, groundwater flooding, or historic flood events.

A developer purchased a Flood Zone 1 site, assuming straightforward drainage design. Post-purchase, detailed surveys revealed the site occupied a natural depression that collected surface water from surrounding higher ground. Historic drainage ditches had been infilled decades ago, removing the site's natural drainage routes. Creating adequate surface water drainage required significant attenuation storage and a pumping system—£95,000 of unexpected cost.

The Water Challenge

Surface water management has become increasingly stringent. Lead Local Flood Authorities (LLFAs) now approve surface water drainage strategies for most major developments, applying Sustainable Drainage Systems (SuDS) principles that require infiltration testing, attenuation calculations, and demonstrating betterment over existing runoff rates.

Many sites—particularly heavy clay subsoils, areas with high water tables, or previously developed land with compacted ground—have poor infiltration characteristics. When infiltration drainage isn't feasible, surface water must be attenuated in tanks or ponds and discharged at controlled rates to watercourses or sewers. This requires land (attenuation tanks or ponds occupy significant site area), capital cost for construction, and ongoing maintenance liability.

What to Check

Review Environment Agency flood maps for river, sea, and surface water flood risk. Don't stop at zone classification—examine historic flood events, flood defences, and climate change allowances. The EA maintains records of previous flooding incidents; flood risk that occurred once can occur again.

Commission infiltration testing early. Trial pits and infiltration tests cost £1,500-3,000 but provide definitive answers about whether soakaway drainage is feasible. If infiltration is poor, attenuation drainage is required—factor this into cost estimates.

The Viability Test

Drainage abnormals can easily add £50,000-150,000 to development costs. Large attenuation tanks or ponds for a 20-unit development might cost £60,000-100,000 to construct. Pumping stations—required when gravity drainage isn't achievable—cost £40,000-80,000 and create ongoing maintenance liability that purchasers may resist adopting.

The question is whether these costs can be absorbed within project economics. If drainage infrastructure consumes 5-8% of total development value, the site remains viable. If it exceeds 10-12%, viability is threatened. Pre-purchase due diligence quantifies drainage costs before you're committed.

Risk 5: Planning Policy & Constraints

Planning permission exists on the site, so surely planning policy isn't a risk? Unfortunately, extant planning permission doesn't guarantee viability. Outline permissions may have been granted subject to conditions that prove expensive or unachievable. Reserved matters applications may face different policy interpretations than the outline approval. And planning policy constantly evolves—particularly around environmental requirements.

The BNG Burden

Biodiversity Net Gain became mandatory from 12 February 2024 (for major development) and 2 April 2024 (for small sites) under the Environment Act 2021, requiring 10% net gain measured using the Statutory Biodiversity Metric (GOV.UK). For brownfield sites or intensive agricultural land with low baseline biodiversity, achieving 10% uplift is relatively straightforward. For sites with existing moderate or good condition habitats, achieving net gain whilst developing the site becomes challenging.

Small sites struggle to achieve 10% on-site gain because habitat creation requires space—often 20-30% of site area for meaningful ecological enhancement. This reduces developable area and affects density. The alternative is purchasing off-site biodiversity units from habitat banks or statutory credits, with statutory credits starting around £42,000 and increasing substantially depending on habitat type (2024 prices). A development requiring three biodiversity units could face £126,000+ of BNG costs.

According to the Home Builders Federation's 2025 report, 98% of SME builders find BNG implementation challenging due to technical complexity, local authority capacity issues, and cost implications. Pre-purchase due diligence must include preliminary ecological appraisal identifying baseline habitat value and assessing whether 10% gain is achievable on-site. If not, off-site provision costs must be factored into viability.

What to Check

Commission preliminary ecological appraisal (PEA) before purchase—this costs £1,500-3,000 and identifies habitat baseline, protected species potential, and BNG feasibility. If the PEA recommends seasonal surveys, factor the delay into your programme. If off-site BNG provision appears necessary, obtain quotes from habitat banks.

Obtain pre-application planning advice. This costs £500-5,000 depending on authority and scheme complexity, but provides written confirmation of policy requirements, likely conditions, and planning officer concerns. This is the single most valuable due diligence step for assessing planning policy risk.

The Sovatech Approach: Informed Acquisition Decisions

At Sovatech Consulting, we coordinate technical due diligence investigations for developers and landowners assessing acquisition opportunities. Our service brings together the specialist inputs required—boundary verification, constraints analysis, infrastructure feasibility, regulatory compliance assessment—into a comprehensive technical due diligence report that informs go/no-go decisions.

We understand the pressure developers face in competitive land markets. Vendors want quick exchanges with minimal investigation. Competitive bidding creates pressure to exchange before comprehensive due diligence is complete. But purchasing land without understanding abnormals is gambling, not investing.

Our role is providing the technical evidence that supports informed decisions. Sometimes that evidence confirms a site is straightforward and represents good value. Sometimes it reveals abnormals that justify price renegotiation. And sometimes it demonstrates a site isn't viable at any price—saving our clients from expensive mistakes.

If you're assessing land acquisition opportunities and need technical due diligence to inform your purchase decision, contact Sovatech Consulting. We'll coordinate the specialist investigations required and provide clear technical advice on site viability, abnormals costs, and risk factors—helping you make informed investment decisions before you're contractually committed.